How to Handle Insurance Claims for Hail and Storm Damage Insurance

Summer is the time of year where random hit-and-miss storms bring high winds, hail, flooding downpours, lightning and thunder to our area. If you are a homeowner unlucky enough to experience one of these bad boys of summer, knowing how to deal with the aftermath can make all the difference on getting your life back to normal.

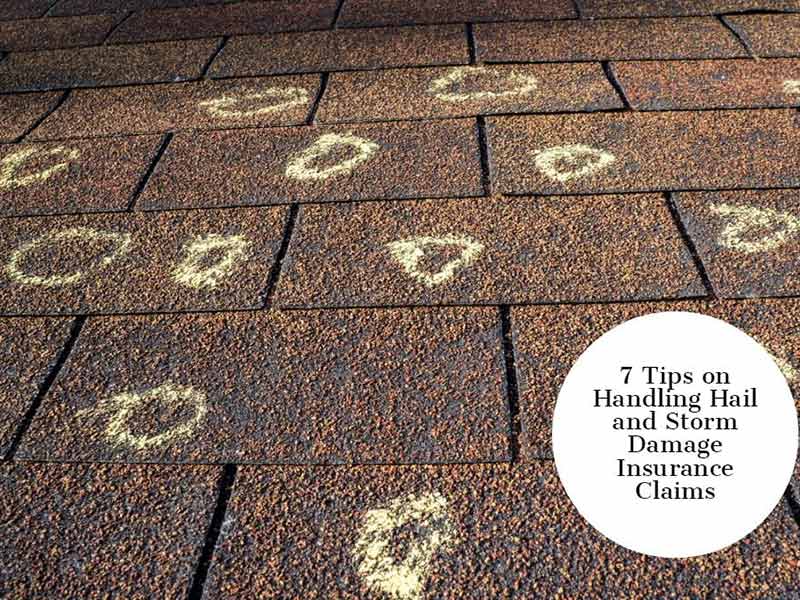

After major wind or hail storm has hit your area, it can be apparent that your home is in need of repair. Missing or torn shingles, dented or scarred siding, cracked windows, downed gutter spouts can be some or all of the side effects of hundred balls of ice being pelted against your home.

1) Immediately after the Storm Contact Insurance Company and Contractor:

When a storm does such a large amount of damage to your home, it can be intimidating and surreal. Now is not the time for panic or inaction. It is important to reach out to your insurance agency and a contractor you can trust as soon as possible. Especially when large areas affected, as most contractors and insurances companies operate on first case basis.

2) Get your facts all in a row:

- Take pictures of any pieces of hail against a measuring tape or ruler and a round object similar in size, such a ping-pong ball similar in size

- Note the date and exact time that the storm hit

- Take plenty of photos of your home’s interior and exterior, plus surrounding property

- Be sure to focus on any obvious signs of damage, such as dented siding and torn shingles

- Check out roof, siding, windows, gutters and doors

- Don’t forget to check out any equipment, such as air conditioner for damage

3) Storm and Hail Damage Is NOT Always Visible:

Keep in mind that the effects of storm and hail damage can be invisible for a while. A few months later, a homeowner may discover a leak caused by damaged shingles that went unnoticed. That is why it’s important to have a professional contractor come out to access your home.

4) Meet Face to Face:

Arrange for your contractor and the insurance adjuster and yourself to meet to face-to-face. It is important to make this in person meeting so that your contractor and you can voice your concerns with the insurance adjuster

5) Get Multiple Estimates and Negotiate with Insurance Company:

You do NOT have to accept the first claim check sent by your insurance company if it fails to encompass scope of work. Obviously, they hope you accept the check without question. You should ALWAYS get multiple estimates to better position yourself for negotiation.

DO NOT DEPOSIT ANY CHECKS UNTIL YOU HAVE REACHED A REASONABLE AMOUNT AGREEMENT WITH THE INSURANCE COMPANY, AS MAY TRIGGER THE CLOSING OF YOUR CLAIM WITHOUT ANY FORM OF REDRESS.

You also have the right to hire an independent adjuster to negotiate and submit their report of damage when the insurance company is trying to short your claim. If that stalls or goes nowhere, there is also the option to contact your state’s insurance commissioner and/or an attorney.

6) Beware of Storm Chaser Contractors:

It is best to use a local contractor with an excellent reputation and a local address that has been around for at least 2 years. Storm chasers might offer amazing deals because they are here to do multiple homes in your neighborhood in a short amount of time. They will be long gone when it comes to any warranty or accountability.

7) Take This Opportunity for Home Improvements:

While your insurance company will not pay for any upgrades, you might want to use your misfortune of storm damage to make certain home improvements. For example, if you have to do a full roof replacement and your home is craving natural light, adding a skylight or sky tunnel may make sense. Likewise, if your utility bills are high due to subpar insulation, you might want to upgrade the insulation while the rafters are easily accessible.